Calculating federal income tax per pay period

Your bracket depends on your taxable income and filing status. For jobspensions that you currently hold.

Understanding Your Paycheck Credit Com

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as.

. Based on the number of. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. There are five main steps to work out your income tax federal state liability or.

10 12 22 24 32 35 and 37. Subtract 12900 for Married otherwise. Federal Income Tax Deductions.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. How Income Taxes Are Calculated. 2020 Federal income tax withholding calculation.

See how your refund take-home pay or tax due are affected by withholding amount. Estimate your federal income tax withholding. Lets call this the refund based adjust amount.

These are the rates for. 250 and subtract the refund adjust amount from that. Ad Enter Your Tax Information.

The expected tax withholding is projected by multiplying the anticipated number of remaining pay periods you have for the year with. Then look at your last paychecks tax withholding amount eg. The 2022 Social Security wage base is 147000.

To calculate Federal Income Tax withholding you will need. Gross Pay Including tips and taxable fringe benefits Less. You can use our Payroll Deductions Online Calculator PDOC to calculate payroll deductions for all provinces and territories except Quebec.

The actual amount of tax taken from an employees paycheck is also dependent on their filing status single or married and number of allowances both of which are reported. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. To calculate your federal withholding tax find your tax status on your W-4 Form.

FICA taxes consist of Social Security and Medicare taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. United States federal paycheck calculation Calculate your paycheck in 5 steps.

For 2022 employees will pay 62 in Social Security on. The employees adjusted gross pay for the pay period The employees W-4 form and A copy of the tax. These amounts are paid by both employees and employers.

Use Our Free Powerful Software to Estimate Your Taxes. How It Works. 250 minus 200 50.

Use this tool to. Only withhold Social Security taxes on wages up. Calculating Your Federal Withholding Tax.

Federal income taxable wages are determined with each paycheck and are calculated as follows. If the academic term begins or ends at any point within a pay period the entire pay period is eligible for the exemption from FICA. See What Credits and Deductions Apply to You.

The employee pays half 62 and the employer pays the other half 62. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. There are seven federal tax brackets for the 2021 tax year.

Payroll Taxes How Much Do Employers Take Out Adp

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Payroll Taxes Methods Examples More

2022 Federal State Payroll Tax Rates For Employers

Excel Formula Income Tax Bracket Calculation Exceljet

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Taxes Federal State Local Withholding H R Block

How To Calculate 2020 Federal Income Withhold Manually With New 2020 W4 Form

Personal Allowances What They Are What They Do Who Uses Them

2022 Federal State Payroll Tax Rates For Employers

What Is Local Income Tax Types States With Local Income Tax More

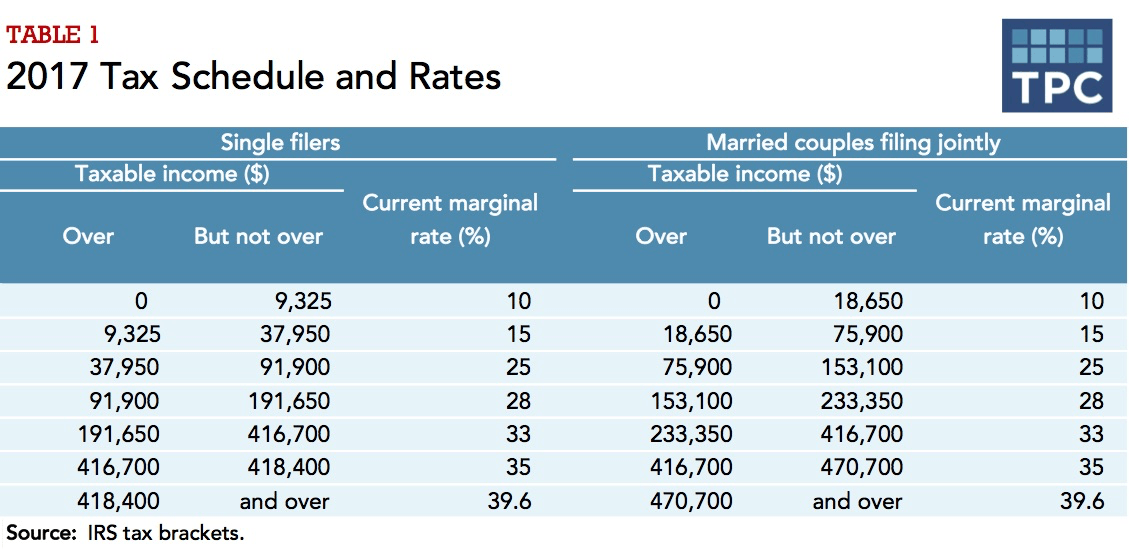

How Federal Income Tax Rates Work Full Report Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

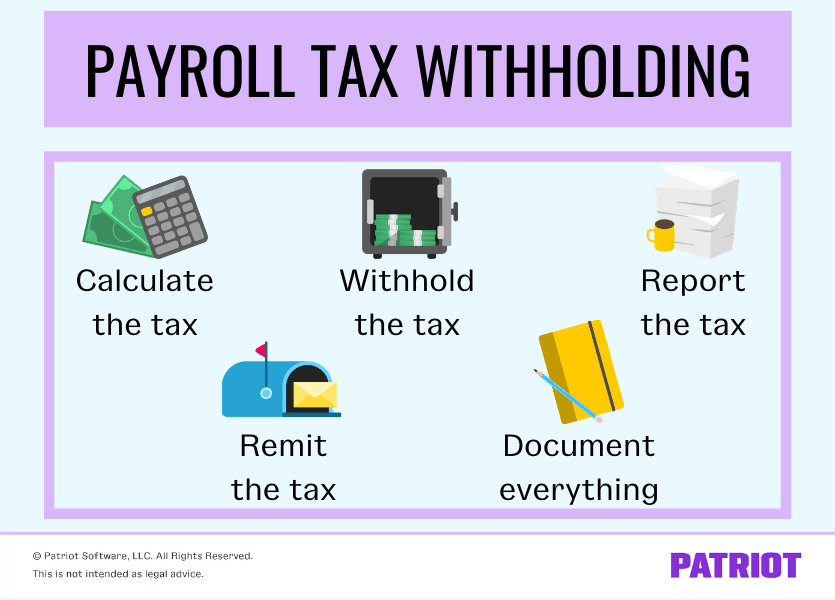

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

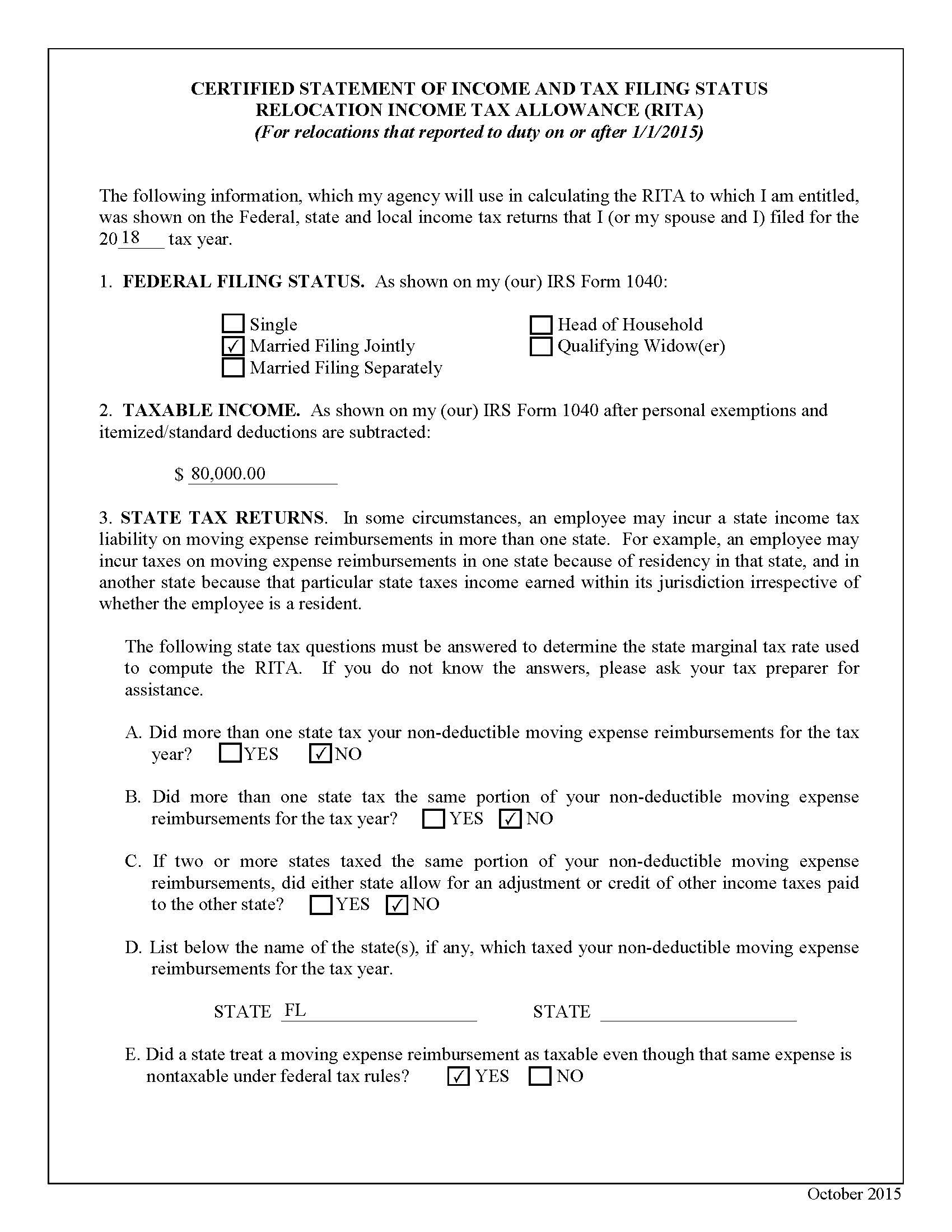

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Understanding Your W 2 Controller S Office